AI healthcare startups raised $808 million in April. This month is an odd one out this year. Deals were at the usual pace, just over 50, but the cash meter stopped, our first sub-billion month of 2025. Instead of the headline-grabbing megarounds we saw in March, investors spread their bets across leaner, workflow-friendly plays.

The vibe felt practical, almost frugal: fix the paperwork choke points, keep patients out of trouble, and save drug discovery moonshots for another day. The charts below show where the money landed, the stories explain why, and the trends hint at what might be next.

As always, if you missed my review last month, you can catch up here in the March Report.

Jump to Section

April’s Funding Overview

In April, AI healthcare startups raised $808M across 56 deals, down from March’s $1.8B. The top rounds this month show a broader diversity in AI applications, away from drug discovery which dominated in March and towards operational efficiency and patient care technologies.

The top four (two tied at third place) funded AI Healthcare companies this month:

Nourish led the month with a big $70M Series B. The company has an AI-driven virtual nutrition care platform to tackle chronic diseases through personalized dietary interventions and lifestyle changes. Backed by J.P. Morgan Growth Equity Partners, Nourish focuses on AI in preventive healthcare and chronic disease management.

deepull raised €50M ($53.5M) in an oversubscribed Series C. The funding will go towards clinical validation of UllCORE, a rapid diagnostic system that uses AI to identify pathogens from blood samples. With FDA Breakthrough Device Designation, deepull is addressing the biggest gap in sepsis diagnosis – one of the deadliest and most expensive challenges in healthcare.

Healthee and Plenful each raised $50M, in different areas of healthcare administration and patient benefits. Healthee uses AI to simplify health benefits for employers and employees, Plenful automates complex healthcare workflows to reduce administrative costs and boost operational efficiency.

Funding Breakdown by Application

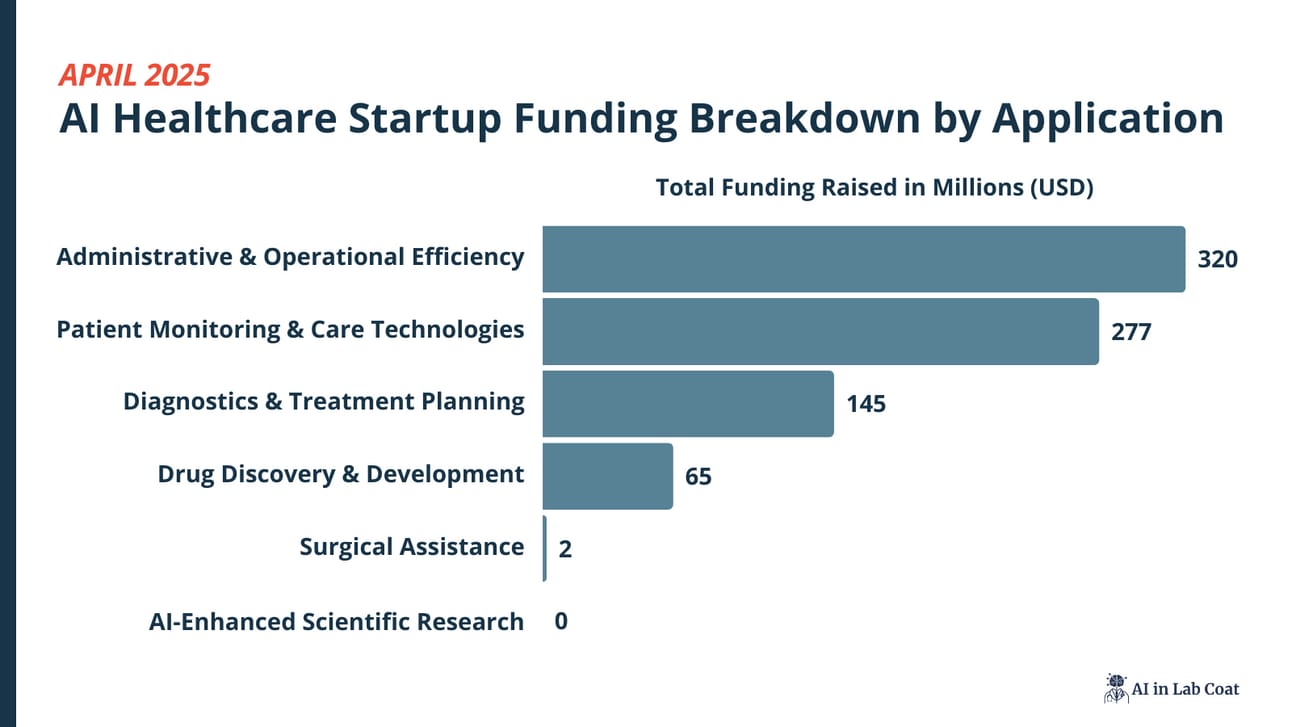

Last month, we saw massive funding raised for drug discovery at $949 million, a total that was larger than the entire month of April’s raised funds. So, it’s not a big surprise that it dropped back down to $65 million this month.

Administrative & Operational Efficiency led the month with $320M, up from March’s $171M, as investors get more interested in practical solutions for healthcare system management.

Patient Monitoring & Care Technologies followed with $277M, slightly up from March’s $245M, as investors are confident in continuous care applications.

Diagnostics & Treatment Planning raised $145M, down from March’s $251M, and Surgical Assistance raised $2M, and AI-Enhanced Scientific Research was at zero.

Geographic Funding Trends

The U.S. was still the leader with $566M but with a big drop from March’s $1B. Europe saw more activity with notable raises in Spain ($54M), France ($45M), and Germany ($31M). The UK, which was prominent last month due to Isomorphic Labs’ big raise, fell to $21M this month. Canada continued to struggle, raising only $4M, despite its potential.

Top 3 Key Events and Trends in Healthcare AI

For April, I’ve narrowed down the most important Healthcare AI developments into three key themes. These are the trends I think will matter most for the industry going forward.

1. EU’s AI Regulation Sets Global Standard

April marked a major milestone as the European Union’s AI Act came into force, classifying healthcare AI tools, including diagnostic and clinical decision-support software, as “high-risk”. This means companies will have to adhere to strict compliance rules, including transparency, rigorous risk assessments, and continuous human oversight.

Non-compliance can result in fines up to 7% of global revenue, so Europe’s rules are now the global benchmark. This is pushing international healthcare AI developers to prioritise safety, clarity and explainability. Companies operating in the EU will have to move fast to meet these regulatory demands and this may impact AI product design globally.

2. Hospitals are Adopting AI at Scale but Safety and Ethics Concerns Grow

Hospitals are rolling out AI at an unprecedented pace. In April, it was reported that over 30,000 clinicians across 40 health systems in the US are using OpenAI’s Whisper for clinical documentation, despite well-documented accuracy and “hallucination” risks. The UK’s NHS is also implementing AI-driven diagnostic tools and moving AI into routine care.

But this rapid adoption is intensifying ethical and safety debates. High-profile studies are still highlighting algorithmic bias and medical bodies such as the American Medical Association and the UK’s Royal College of Physicians are issuing guidelines on human oversight. Clinicians and regulators are saying validated, transparent AI systems are needed to ensure patient safety is not compromised as deployment accelerates.

3. US and China Tensions & Big Tech Shape AI Healthcare Landscape

Geopolitical tensions are impacting healthcare AI indirectly. The US-China trade war escalated in April with the US imposing severe tariffs (up to 145%) on critical AI hardware from China. This will make global supply chain challenges worse and increase operational costs for healthcare AI infrastructure worldwide.

At the same time, Google and Microsoft deepened their healthcare AI partnerships, integrating their AI systems into hospital workflows through EHR integrations (Google with HCA Healthcare, Microsoft with Epic). This shows Big Tech’s growing power and dominance and raises questions about data privacy, vendor lock-in and market competition. Companies and health systems will have to navigate a more complicated landscape with geopolitical friction and Big Tech alliances.

Final Thoughts: My Takeaways from April

April was the first month investors could show signs of a break, we’ll have to see in May. Regardless, money is still being poured into AI healthcare startups.

I’m guessing that mood could carry into May. Compliance tech is ready for its close-up now that the EU’s AI Act is in effect; any startup that can turn an algorithmic spot-check into a one-click report will have investors lining up.

South of the border, state lawmakers in the US are sharpening bills that require hospitals to prove their models are bias-free; once the first one passes, administrators will be scrambling for tools that can pass those tests. And then there’s Canada, waiting in the wings, if Ottawa’s rumored innovation tax credit makes it into the May budget, Toronto and Montreal will have funding in time for patio season.

In short, May will reward the teams that move fast, are pragmatic, and ride the policy waves.

April’s Top 20 Healthcare AI Startup Database

Got feedback or raised funds? Drop a comment—we're always tracking the latest in AI healthcare.